Interest Rates

A lot of people ask me questions about if interest rates go up, if property prices drop or if rent increase in future and how much. Today I will talk about interest rates and in the next 2 weeks, I will share with you more info about property price and rent. Let’s share this blog If you know somebody who may be interested in them. While nobody has a crystal ball but here is my own baseline when planning:

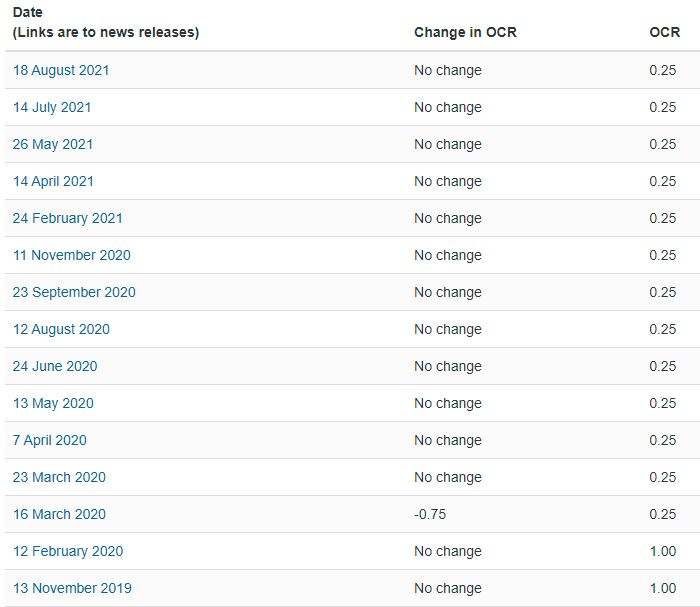

Interest rates were low (around 3.3% 1 year fixed) when the covid-19 pandemic started in March 2020. At that stage, RBNZ (Reserve Bank of New Zealand) reduce OCR (Official Cash Rate) from 1 to 0.25. To keep it very simple OCR is the base interest rate commercial bank (ANZ, BNZ, …) borrow money and add their own cost/margin and sell to people. After OCR drops to 0.25, banks reduce the interest rates to 2.5% (1 year fixed) and later to 2.3% or even 2%. As you see usually interest rates are 1.75% to 2.25% above OCR. This 1.75% to 2.25% are banks margin.

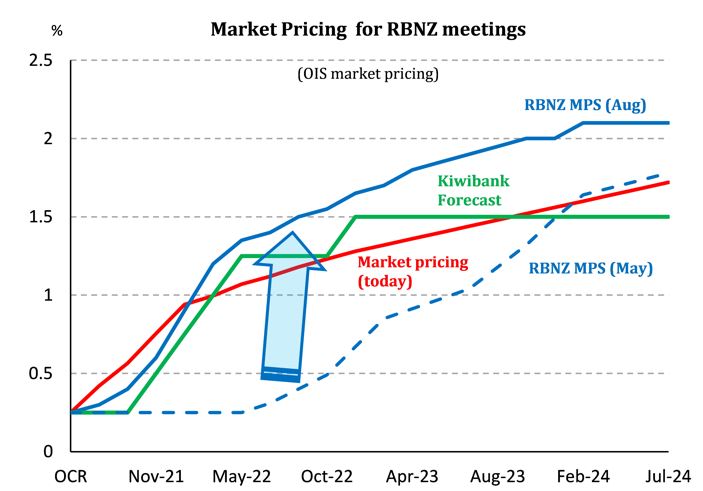

Now we know the calculation let’s see what is RBNZ’s plan for the future. RBNZ had a plan to increase OCR the day new Delta outbreak started. But due to the new lockdown postpone its decision. It is clear RBNZ will increase OCR in near future and banks will raise their interest rate. Even you see some they have started to increase.

Now the question is how much? the answer is nobody knows but Kiwibank prediction is OCR will increase up to 1.5 by mid-2024 (above picture) which is expected interest rates to be 4 or early 4%. With current data, nobody thinks interest rates increase more than 5%. I think still cheap money around for a couple of years.

What is next?

- RBNZ make an OCR announcement on 6 October.

What you can do?

Plan proactively to manage your mortgage or structure your debt correctly. As long as you know the trend, you can make an informed decision. If you don’t know how to start, contact me and I help you start your journey and plan it correctly.