Option A or B?

I highlighted in a previous email 8 August [Be Quick, Banks Changing Regulation] RBNZ (Reserve Bank of New Zealand) is looking for a way to reduce the number of first home buyers to control house price which increasing day to day. Now RBNZ consulting with a wider community to implement option A or B.

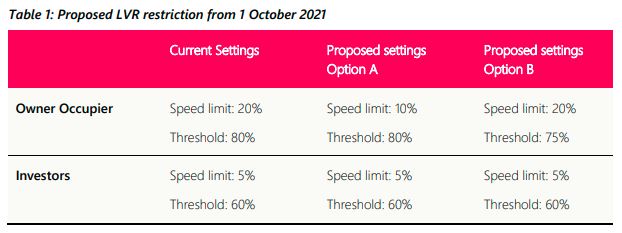

Option A: Fewer people can get a mortgage with a limited deposit (like a 10% deposit). This reduces risky borrowers for banks. Anybody with a 20% deposit can get a loan from the bank as normal (considering fulfilment of other factors).

Option B: number of low deposit (risky) borrowers would remain the same but other normal borrowers need to have a 25% deposit.

As you can see people who are prepared to buy with a 20% deposit may be impacted by option B. There is no change to investors as investor demand has already reduced by 40% deposit (60% LVR) and interest deductibility rule which was introduced on 27 March 2021. It is clear RBNZ & government will do whatever is required to reduce demand. I am not surprised if RBNZ implements option A & B together and even introduce further rules in the next 3~6 months if the property market is out of control.

What is next?

- RBNZ make a decision on 17 September.

- The new rule will be implemented by 1 October.

What you can do?

Plan proactively your property purchasing project, whatever RBNZ doing you need to have plan B. Be ready for the next RBNZ announcement. If you don’t know how to start, contact me and I help you start your journey and plan a workaround.

Let’s forward this email If you know somebody who may be impacted by these new rules.