Property Market Update

There were two new announcements recently which I want to explain further in this week post. Both of them will play a key role in how the market work in the short term and long term. The 3rd part INTEREST RATES, PROPERTY PRICE, RENT will be published next week.

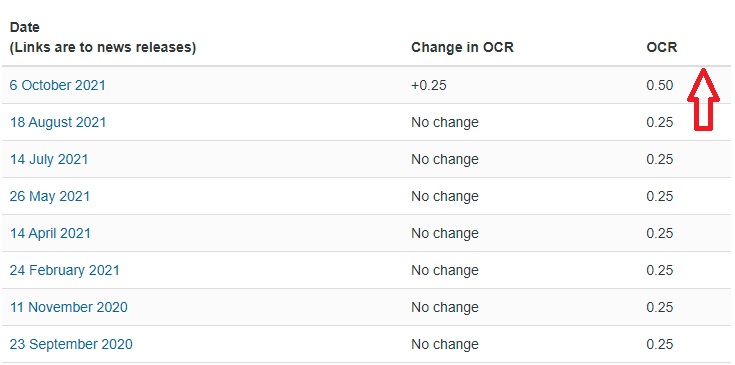

As you read in the interest rates post, we were expecting RBNZ announce a new OCR this week, meanwhile the government release more details about interest deductibility and a new build definition recently. Let’s go to details:

OCR

- As expected RBNZ increased OCR from 0.25% to 0.5% 6 Oct., this is a first-time increase from July 2014. It is an important turnaround to show RBNZ plan to control inflation which is sitting at 3.3% now. It means from now on the interest rate goes up.

- In this post, I explained how OCR and interest rate work together, banks mainly push up their floating rate in the 4% range after the OCR announcement.

- Bank didn’t change their fixed rate by OCR change because they have recently increased them. For example 1 year fixed from lowest 2.16% increased to around 2.85%.

Interest Deductibility – Bright Line Test – New Build

Government announce further about interest deductibility law, please note this is not finalized and is subject to further adjustment.

- New builds are exempt from interest deductibility for 20 years (expectation was 5 or 10 years). This exemption transfer to other owners for 20 years from CCC (This is also new).

- The definition of new builds are any home get CCC from 27 March 2020 (careful 2020 last year not 2021).

- Meanwhile new builds have 5 years bright-line instead of other properties that have 10 years.

These are motivated investors demands shift to new builds which unfortunately make new builds more expensive for first home buyers.

What you can do?

- It is a good time to have a strategy for long term mortgage interest rate management. If you don’t know-how, you can contact me.

- If you are planning to buy a new-build may be a good idea to be fast or rethink your strategy to focus on a different product. If you don’t know what other options you have, you can contact me.