Property Price

Average property prices raised 650% over the past 30 years, 150% in the past decade, and 31% in the past year in New Zealand (I encourage you to read it again and think for while).

A lot of people ask me questions about if interest rates go up, if property prices drop or if rent increase in future and how much. Last week I review interest rates, today I will talk about the house price and in the next week, I will share with you more info about rent. Let’s share this blog If you know somebody who may be interested in them. While nobody has a crystal ball but here is my own baseline when planning:

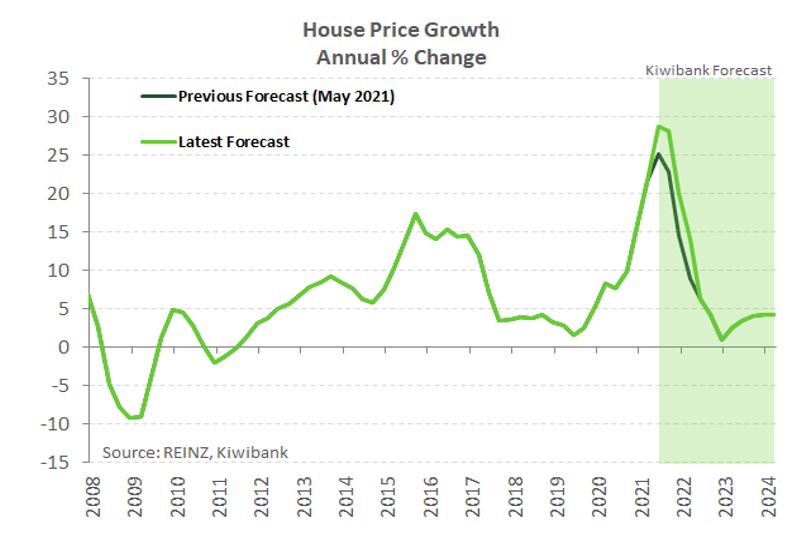

There is a rule of thumb property price double every 10 years while this was correct there is no certainty it will increase at the same rate in feature. Most important some years increase was higher and some years the property market is quiet. Then right timing sometimes can keep 200K in your pocket. Property prices decline up to 10% after GFC but after that slowly recovered from 2012. This price increase continue till the end of 2016 when the house price was 15% per year. In 2016 government introduce 60% LVR (40% deposit required for investors). This decision results in property price gross reduction to less than 5%. As construction is an important business sector for the New Zealand economy government relax LVR to 65% then 70% and finally 80% when level 4 lockdown starts early 2020.

Another government action starting lockdown was reducing the interest rate, this result people renting think buy home and pay mortgage cheaper option. The LVR change (20% deposit for an investor) plus low-interest rate which create first home buyers and demand which was suppress between 2017~2019 create that big demand in the market result 31% property price increase.

Now you know history let see what happen later, government introduce 60% LVR for investors in March 2021 plus interest deductibility which almost killed the investment market. After 2~3 months, data shows price increase continues and this price increase comes from first home buyers. Go to details shows low deposit buyers (less than 20%) are playing key demand which results in the government decide option A (read more about it here). Again government will monitor the market and if the price increase continues they will introduce new rules (For example debt to income – DTI or 25% LVR for first home buyers).

Kiwibank projection is price increase reduces to less than 10% in 2022 and near-zero end of 2023. Please note their projection is property prices will increase in the next 3 years but not out of control.

This is the big picture for the property market, different regions, cities, suburbs will have a different gross path. We need to consider houses, townhouses and apartments also will have a different gross path. Other factors which accelerate price increase could be a material shortage, expensive labour and new government announcement about the residency of 165K people which finally increase housing demand. My own expectation is the government will control significant price increase with whatever tool they have.

What is next?

- Check news about changes government & RBNZ makes to control house price. I will share update weekly in this blog. This will give you the big picture.

What you can do?

If you buying your first property, if you are selling and upgrading your owner-occupied home, if you want to invest in property you need to know how the market performing in the whole country and in that area. As long as you know the trend, you can make an informed decision. If you don’t know how the area you want to sell or purchase contact me and I can help you to make informed decision.

2 thoughts to “Interest Rates, Property Price, Rent (2/3)”

Not dealing investors eh Matt? Interesting news you are posting, looks very familiar in many respects to my information for my PCMG members only…

Hi Kieran, thanks for reading and put comments on my blog. Your PCMG information is defanitely more valuable, detail than mine. I put your site detail here (https://tellmethetime.co.nz/) in case anybody is interested in more details. Regards Matt