Option A From

1 Nov. 2021

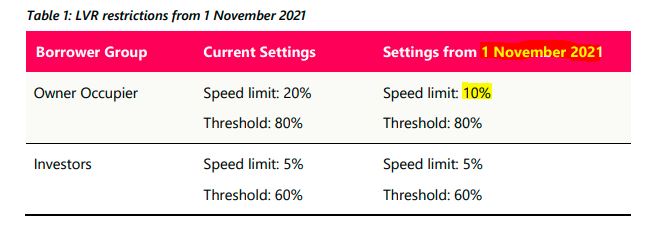

I highlighted in a previous communication [Be Quick, Banks Changing Regulation] & [Option A or B] RBNZ (Reserve Bank of New Zealand) is looking for a way to reduce the number of first home buyers to control house price which is increasing day to day. RNBZ announce today option A selected but implemented from 1 Nov. 2021. Option A is fewer people can get a mortgage (home loan) with a limited deposit (like a 10% deposit). This reduces risky borrowers for banks. Anybody with a 20% deposit can get a loan from the bank as normal (considering fulfilment of other factors).

Who is impacted?

- If you have less than a 20% deposit you need to hurry to get your mortgage approval as soon as possible. Potentially your chance 50% less after 1 Nov.

- If you have 20% deposit then business as usual for while. You have a choice to wait for a while to see if the market cools down but don’t wait so long as a new rule may come in place.

- No impact to investor borrowing.

What you can do?

Check my next blog next week about property price, plan proactively for your property purchasing project. This is not the last change and I am sure more coming. If you don’t know how to start, contact me and I help you start your journey and plan a workaround.