RBNZ Goes Hard and Fast

While I was busy helping my clients buy awesome properties, there were continuous changes in the market, here is some update. Annual inflation was at 5.9% in the December quarter and it is expected to peak at around 7% in the first half of 2022. While inflation is above target and employment is above its maximum sustainable level. RBNZ (Reserve Bank of New Zealand) took hard and fast action today to control the situation. I liked one news headline said “RBNZ puts the pedal to the metal“

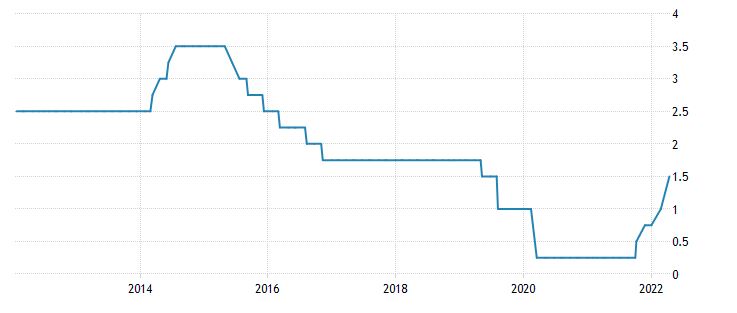

The Reserve Bank of New Zealand lifted the official cash rate (OCR) by 0.5% to 1.5%, stating it was better to move higher now rather than later. It is a double increase this time as usually RBNZ increase OCR by 0.25%. This gives a clear message to the financial market that RBNZ wants to control inflation to 1% and 3%.

Although property prices increased about 30% last year but this one is not directly measured in inflation. On the other side rent prices are up 3.7% in comparison to last year. The measure shows price changes across the whole rental population, including renters currently in tenancies. RBNZ highlighted in his report while record high home building intentions will assist property price adjustment, “construction activity faces challenges, including access to land, rising building costs, ongoing supply chain bottlenecks, and limited access to labour,”.

For the housing market, even though mortgage rates have already been rising again in recent weeks, this process isn’t over yet. Many “special” fixed-rate mortgages in the popular 1-2 year terms are currently in the range of 4-5%, and it seems fair to suggest that this could end up in the range of 5-6% over the coming months.

What is next:

- If you are a homeowner or person who may get a mortgage soon, correctly plan your finance to protect yourself, your family and your asset in this environment.

- If you were planning to buy a property or you have a plan to buy depends on your financial situation opportunity window is opening or closing.

If you need help on the above 2 items let me know. Again you need to act correctly in your opportunity window which depends on your financial situation! Get your personal advice free here.